Singapore National Eye Centre will NEVER ask you to transfer money over a call. If in doubt, call the 24/7 ScamShield helpline at 1799, or visit the ScamShield website at www.scamshield.gov.sg.

FAQs

Frequently-asked-questions (FAQs)

Q: Why does it take so long to receive the final bill and refunds for deposit made?

A: After the day surgery procedure, SNEC will submit the patient’s bill to Central Provident Fund (CPF) and the Medical insurer* to assess the claims. Patients will receive the finalised bill typically about a few days to two weeks or more after the surgery date.

If the insurer requires clarification on the medical claims then the processing time may take longer. The final bill will reflect the outstanding amount which needs to be paid.

Q: I lost or cannot find my original tax invoice. Can I obtain another copy?

A: Yes, you may obtain a duplicate certified true copy of the tax invoice. There is a charge of $5.35 per duplicate invoice. Please contact Business Office at 6322 8837.

However if you opt in to Mobile Pay or Online payment you can download the invoice from your mobile phone or log in with your SingPass at https://eservices.healthhub.sg/public/payments/singhealth.

Q: I am a Civil Service Card (CSC) Holder. How is the payout on the medical bills going to be like?

A: The payout of your medical bills is dependable on your medical benefit schemes. The hospital submits your medical bills online to AGD office for them to process the medical claims and payout amounts.

For queries on CSC medical benefits and bill items exclusions, please contact AGD office or refer to the link below for queries relating to your CSC medical benefit schemes.

http://www.agd.gov.sg/pensioners-portal.html

A: You can use your Medisave to pay for your surgical bills for yourself or your immediate family members including your spouse, children, parents and grandparents. They can be of any nationality, except for grandparents who must be Singapore Citizens or Permanent Residents.

Medisave CAN be used at SNEC for the following:

You may use your Medisave to pay for the hospital bill of non-immediate family members (i.e, brother, sister, uncle, aunty, in-laws, niece and nephew), provided that the patient:

Is a subsidised payment class

Is a Singapore Citizen or a Permanent Resident

Does not have a Medisave account

Has immediate family members who do not have enough Medisave funds and cannot afford to pay for hospital bill

Is a dependant of the Medisave account holder

For more information for Medisave withdrawal limits please visit the MOH webpage on Healthcare Financing.

Flexi-Medisave for the Elderly

For all patients aged 65 and above. Up to $200 per patient per year for outpatient medical treatment at Specialist Outpatient Clinics in the public hospitals and national specialty centres.

Medishield for Singaporeans and Permanent Residents

MediShield Life is a basic health insurance plan, administered by the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer.

MediShield Life coverage is sized for subsidised treatment in public hospitals. Medishield Life can be used to pay for your day surgical bill. Private paying patients are also covered by MediShield Life. However, as MediShield Life payouts are pegged at subsidised treatment cost, the MediShield Life payout will make up a small proportion of the bill only. The patient may therefore need to pay more of their bill from Medisave and/or cash.

Apart from the MediShield scheme, you can upgrade your plan to Medisave-approved Integrated Shield plans offered by private insurers.

Click here for information on private medical insurance (PMI).

Medisave-approved Integrated Shield or Private Medical Insurance (PMI)

An Integrated Shield Plan (IP) is a medical insurance plan which offers additional benefits on top of that provided by MediShield Life.

If you are covered by one of the following plans, you have an integrated plan.

Click here for information on private medical insurance (PMI).

Q: What is a letter of guarantee (LOG)? Why do I need to submit a LOG before surgery?

A letter of guarantee (LOG) is an assurance of payment offered by insurers to hospitals, on behalf of a patient, for the portion of the hospital bill covered by insurance. The purpose of the LOG is for you to obtain a waiver of the upfront cash deposit required by the hospital. Most of the time, the LOG is only applicable to hospitalisation and surgery, it does not apply to outpatient treatment.

Please note that the issuance of a LOG does not mean that insurer approves or admits any claim. The claim will still be subject to a review by the insurer.

If your company is paying for your surgery bills, you should email your company LOG to SNEC Business Office at email: eboff@snec.com.sg prior to your surgery. A company LOG is an assurance of payment by the patient’s company to hospitals, on behalf of their employees for the portion of the hospital bills.

Q: Where can I view my outstanding bills and how can I make payment?

You can view and pay your outstanding bills via:

Internet and Mobile Payments:

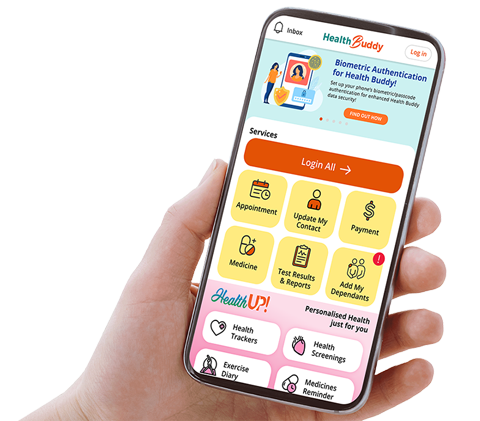

Mobile Payment via Health Buddy Apps

Internet Payment at the link below: https://eservices.healthhub.sg/public/payments/singhealth (by credit cards)

AXS Mobile Payment App or AXS e-station at www.axs.com.sg - by NETS or credit card.

DBS Bill Payment Service via

> Internet Banking

> Mobile Banking

> PayLah! Apps

Self-Service Automated Station

- AXS stations - by NETS , Diners , Citibank Visa or Mastercard

By Mail

Cheque should be crossed and make payable to “Singapore National Eye Centre”.

Credit Card Mail Order, please fill in your credit card details on the credit card payment slip and mail to “ Singapore Health Service Pte Ltd, Bukit Merah Central Post Office , PO Box 540, Singapore 91153

Click here for Bill Payment Options <hyperlink>

Q: I have overpaid my medical bills. How do I get back my refund?

A: Refunds, if any, shall be used to offset against all outstanding inpatient, outpatient and/or pharmacy bills. For payments made via credit card, refunds will be credited back to the same credit card. For payments via cash, NETS or cheque, refunds will be made via cheque or cash (upon request). Your refund will be processed within 10 working days of the final bill date.

Stay Healthy With

© 2025 SingHealth Group. All Rights Reserved.